The regulatory landscape for stablecoin staking is evolving rapidly as governments and financial institutions seek to establish clearer frameworks. In 2025, several changes are expected to shape the way investors and platforms operate. This article explores potential regulatory shifts and their impact on the stablecoin staking ecosystem.

Many jurisdictions are working on implementing more stringent oversight over stablecoin staking platforms. Regulators aim to introduce new licensing requirements, stricter KYC (Know Your Customer) and AML (Anti-Money Laundering) policies, and enhanced reporting obligations for platforms offering staking services.

Some governments may classify stablecoin staking as a financial service, bringing it under existing financial laws. This could lead to greater consumer protection but may also result in increased compliance costs for platforms, potentially affecting staking yields.

Governments are expected to introduce clearer tax guidelines regarding staking rewards. Potential changes include:

Regulators may impose stricter requirements on stablecoin issuers regarding reserves, transparency, and redemption policies. These changes could impact the availability and stability of staking rewards linked to certain stablecoins.

As stablecoin staking operates on a global scale, international regulatory bodies may seek to harmonize policies across different regions. This could lead to:

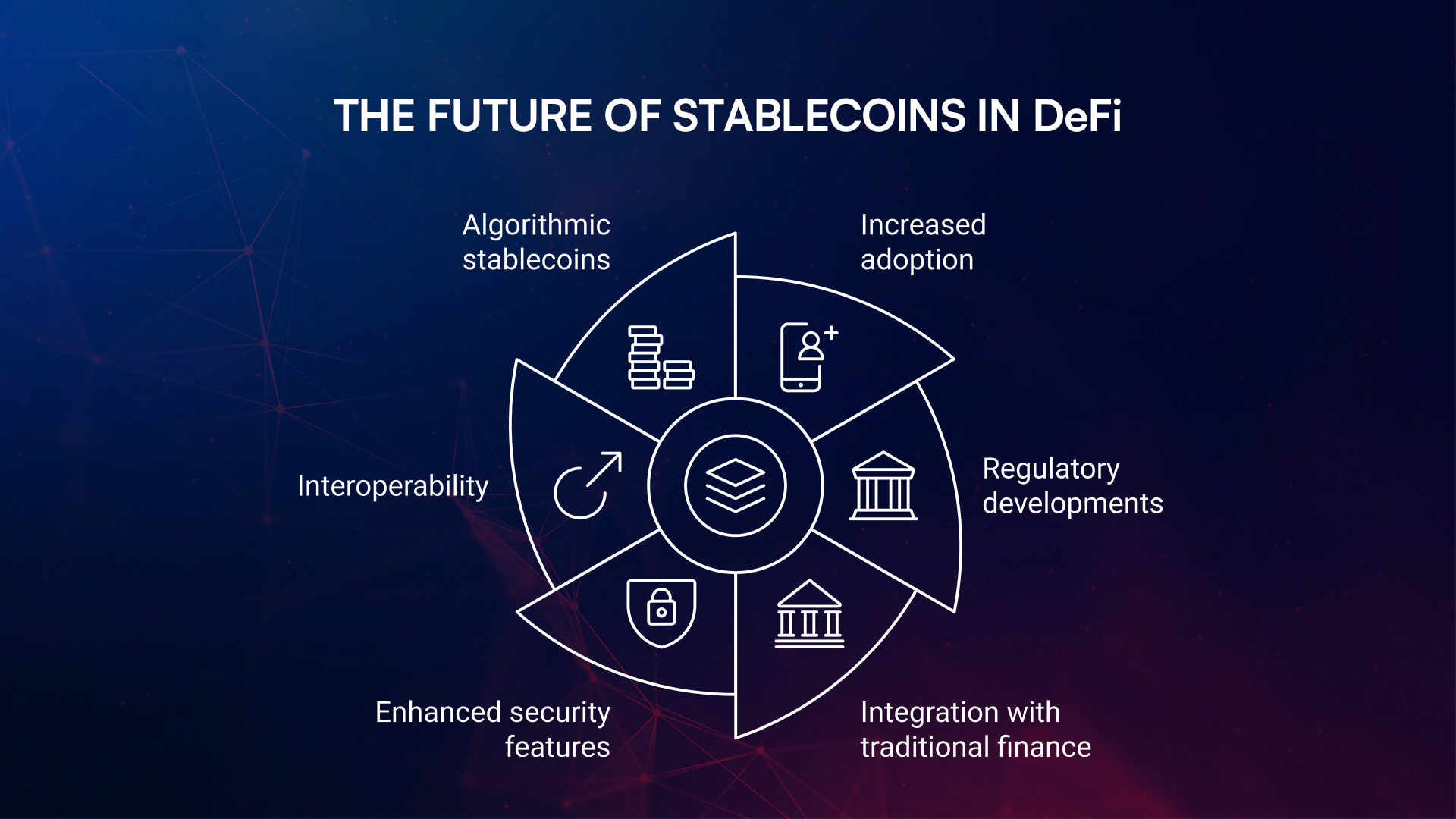

The stablecoin staking industry is poised for significant regulatory changes in 2025. While increased oversight may enhance investor protection and legitimacy, it could also introduce new challenges such as lower yields and compliance burdens. Investors should stay informed about regulatory developments to adapt their staking strategies accordingly.